Our approach to investment management

Proven investment platform

Some firms use the term “open architecture” to mean they act solely as a manager of external managers. At CIBC Private Wealth, open architecture means we are open to excellent investment ideas for our clients, whether they emanate from our select number of internal strategies or from external managers after thorough due diligence.

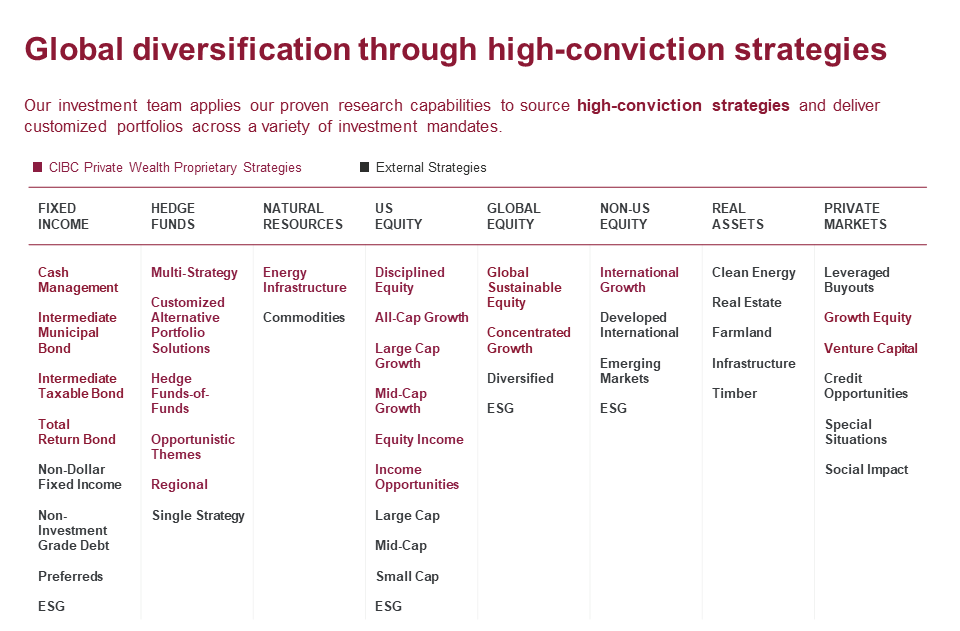

Broad, globally diversified investment offering

Internal expertise

Beating the market is no easy thing, and we attempt to do so only where we believe we have seasoned professionals with a high-conviction investment philosophy and a performance edge. Importantly, our internal managers undergo the same intense scrutiny as our external managers.

External expertise

In a typical year, there are approximately 100 external managers on our platform, covering almost every asset class and strategy: public equity, fixed income, hedge funds, private markets, real assets and ESG and impact investing.

Customized portfolios

For your portfolio, we think about your family and your specific goals and needs, and we give you a customized investment portfolio that brings to you the best from the world’s investment opportunities and managers. We use a disciplined asset allocation process to structure a long-term plan designed to meet your objectives.

Investment solutions

You come to us with wealth, and it’s our job to preserve it and grow it in a careful and measured way over time. We aren’t seeking to take any unnecessary risk, but rather, to provide you with some liquidity, competitive risk-adjusted returns and as smooth a ride as possible.

CIBC Private Wealth includes CIBC National Trust Company (a limited-purpose national trust company), CIBC Delaware Trust Company (a Delaware limited-purpose trust company), CIBC Private Wealth Advisors, Inc. (a registered investment adviser)—all of which are wholly owned subsidiaries of CIBC Private Wealth Group, LLC—and the private banking division of CIBC Bank USA. All of these entities are wholly owned subsidiaries of Canadian Imperial Bank of Commerce.

This document is intended for informational purposes only, and the material presented should not be construed as an offer or recommendation to buy or sell any security. Concepts expressed are current as of the date of this document only and may change without notice. Such concepts are the opinions of our investment professionals, many of whom are Chartered Financial Analyst® (CFA®) charterholders or CERTIFIED FINANCIAL PLANNER™ professionals. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the U.S.

There is no guarantee that these views will come to pass. Past performance does not guarantee future comparable results. The tax information contained herein is general and for informational purposes only. CIBC Private Wealth Management does not provide legal or tax advice, and the information contained herein should only be used in consultation with your legal, accounting and tax advisers. To the extent that information contained herein is derived from third-party sources, although we believe the sources to be reliable, we cannot guarantee their accuracy. The CIBC logo is a registered trademark of CIBC, used under license. Approved 2678-23.

Investment Products Offered are Not FDIC-Insured, May Lose Value and are Not Bank Guaranteed.

David L. Donabedian

Chief Investment Officer, CIBC Private Wealth

“A guiding principle of our investment offerings to our clients is: Would we buy this for ourselves? This is particularly true for our internal, proprietary strategies, which are based on what we believe is differentiated expertise inside the firm. All internal strategies must meet a high bar for the competition within their investment categories. Because we combine that standard with the breadth of knowledge on our Multi-Manager Investment Team, which researches global external managers across a wide range of asset classes, we have something unique and incredibly strong.”

California residents, click here for the California Privacy Policy